Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Take control of your finances with our beginner’s guide to *Mastering Personal Finance*. Learn essential strategies for budgeting, saving, investing, managing debt, setting financial goals, and boosting your credit score. Empower yourself with the knowledge to achieve financial success!

In today’s fast-paced world, financial freedom might seem like a distant dream. But mastering personal finance is the key to turning that dream into reality. Whether you’re just starting out or looking to improve your financial habits, understanding the basics of money management can transform your life.

In this beginner’s guide, we’ll walk you through actionable steps—from budgeting and saving to investing and debt management—that will put you on the path to financial independence. Let’s dive into the journey toward financial freedom!

Take control of your finances with our beginner’s guide to Mastering Personal Finance. Learn essential strategies for budgeting, saving, investing, managing debt, setting financial goals, and boosting your credit score. Empower yourself with the knowledge to achieve financial success!

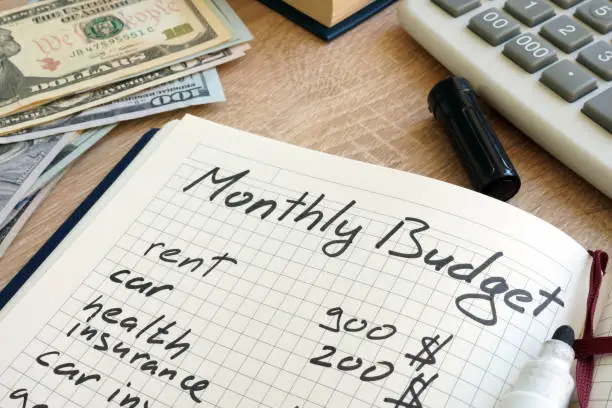

A budget is more than just a list of numbers. It’s a plan that allows you to take control of your money by assigning every dollar a purpose. Creating a budget is the first step toward financial stability and freedom.

At Batewise, we provide professional tools and cutting-edge technology to help you create and manage your budget seamlessly. Our platform will offer:

Savings act as a safety net for life’s unexpected events. Whether it’s medical expenses, car repairs, or job loss, having savings helps you avoid financial stress.

To calculate your emergency fund, multiply your monthly expenses by 3 to 6 months. This ensures you have a cushion to cover essential expenses in case of emergencies.

Batewise will guide you with expert insights on building and maintaining a strong emergency fund, providing calculators to determine the right amount to save.

Investing is the key to growing your wealth over time. It allows you to put your money to work, generating returns that can lead to financial independence.

At Batewise, we’ll provide professional guidance and help you make informed investment decisions with our tailored recommendations and tutorials.

Debt can be categorized into various forms, such as:

At Batewise, we’ll help you develop personalized debt management strategies to reduce your financial burden and achieve debt-free living.

Financial goals give your money a purpose and help you stay focused. Without clear goals, it’s easy to drift away from your financial priorities.

Batewise will equip you with tools to set clear financial goals and track them consistently, ensuring you stay on the path to financial freedom.

A good credit score can open doors to lower interest rates, better loan terms, and even more job opportunities. It’s an essential part of your overall financial health.

At Batewise, we provide comprehensive credit score analysis tools to help you maintain a healthy credit profile.

Mastering personal finance is a journey, and by focusing on budgeting, saving, investing, managing debt, and understanding credit, you can build a solid foundation for financial freedom.

As a devoted golf player, I can not worry sufficient exactly

how important the right accessories are to not only appreciating the video game but also enhancing your performance on the program.

Golf is as a lot a mental game as it is physical,

and having the appropriate gear can truly make a distinction in how you come close to

each round.

First of all, let’s talk about golf handwear covers.

Many gamers ignore the importance of an excellent glove.

It’s not just about protecting against blisters; a handwear cover

aids you preserve a regular grip on your club, which is essential for regulating your shots.

Specifically in humid or wet problems, a great glove can be the distinction in between a strong drive and a wild

piece. Handwear covers with a tight fit made from top quality natural leather often tend

to provide the best performance. They mold and mildew to your turn over

time, supplying both convenience and integrity.

millionaire is not what I mean here. What I am talking about is learning the fundamental aspects of personal finance management

strategic budgeting practices to track expenses and reduce