Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Learn how to check your HomeReady mortgage eligibility using the AMI tool. Discover income limits, area requirements, and steps to qualify for this Fannie Mae affordable loan program.

The HomeReady mortgage program was launched by Fannie Mae in 2015. It offers low-down-payment mortgages for those with lower incomes. You can put down as little as 3% and include various income sources in your loan application.

To qualify, you must meet income limits set by your area’s median income. The Area Median Income AMI Tool helps lenders and housing experts check if you’re eligible. It uses your area, property address, or Federal Information Processing Standards (FIPS) code.

The HomeReady mortgage program was launched by Fannie Mae in 2015. It’s a great option for low- and moderate-income buyers. It allows a down payment as low as 3%.

This program is perfect for those with flexible income sources and credit score requirements that don’t fit the usual mortgage standards.

The HomeReady program has several standout features:

To qualify for a HomeReady mortgage, you need to meet certain criteria:

The HomeReady program is for those who will live in the property as their main home. The property must be the borrower’s primary residence. It cannot be used as a second home or investment property.

| Eligible Property Types | Loan Terms |

|---|---|

| Single-family homes, condominiums, multi-unit residences (up to four units), and manufactured homes | 30-year fixed-rate mortgages, adjustable-rate mortgages (5/7/10 years) |

Understanding the HomeReady mortgage program’s features and eligibility can help buyers see if it’s right for them. It offers a low down payment option that fits many financial situations.

The Area Median Income (AMI) Lookup Tool helps figure out if you qualify for the HomeReady mortgage. It lets you search by address, FIPS code, state, county, or city. You can find out the AMI, HomeReady Income Limit, and Special Focus Area details for your area.

To find accurate results, enter the full property address and pick from the options. The tool shows the AMI, HomeReady Income Limit, and any Special Focus Area designations. A house icon will appear on the map, and the income limit will be shown clearly.

For the best experience, use Chrome or Mozilla Firefox browsers. The tool works on mobile devices but is better on larger screens. If the tool can’t find your address, lenders can use FFIEC.gov to find the census tract.

| AMI Lookup Tool Key Features | Benefits |

|---|---|

| Search by Property Address, FIPS Code, State, County, or City | Provides precise, location-specific AMI and income eligibility details |

| Displays AMI, HomeReady Income Limit, and Special Focus Area Information | Helps determine if a property and borrower meet HomeReady program requirements |

| Optimized for Chrome and Mozilla Firefox Browsers | Ensures a smooth and efficient user experience |

| Mobile Accessibility (Optimized for Larger Screens) | Flexibility to access the tool on-the-go |

| Alternative Census Tract Documentation Options | Lenders can reference FFIEC.gov for properties not found in the tool |

The Area Median Income Lookup Tool is key for lenders and borrowers to check income eligibility for HomeReady. It gives detailed location data, making it easier to see if a property and borrower qualify.

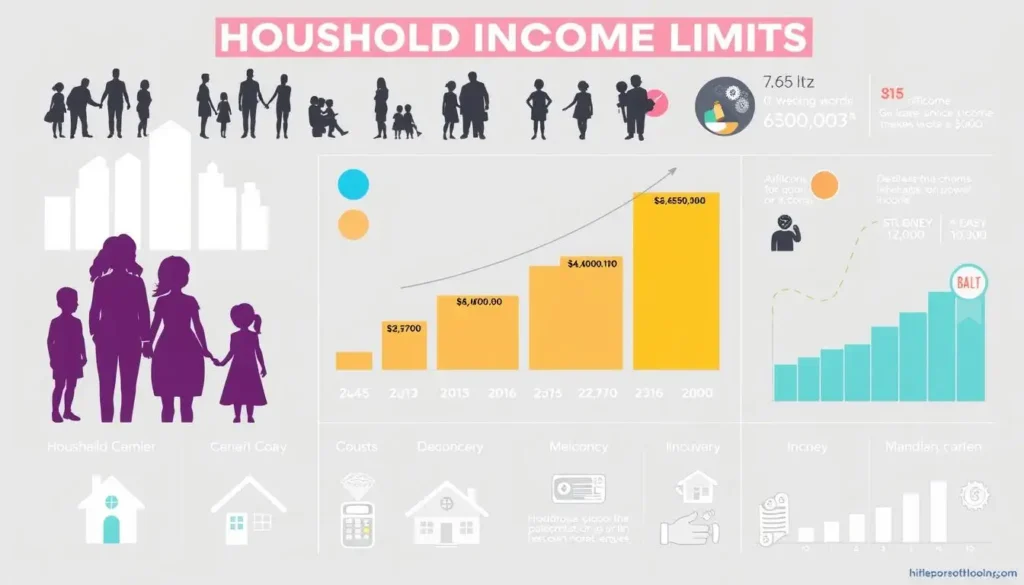

Understanding the income needs and how to qualify for the HomeReady® Mortgage is crucial. The program checks if the borrower’s household income is under 80% of the Area Median Income (AMI) for their area.

Fannie Mae’s AMI Lookup Tool helps find the 80% AMI for any area. Just enter the property’s location to see if your income is eligible. This rule helps the program help those who really need it to buy a home.

Lenders need different documents to check your income. This includes pay stubs, W-2 forms, tax returns, and more. The exact documents needed depend on your income type. They might also use Fannie Mae’s Desktop Underwriter (DU) system to check if you qualify.

Knowing what income and documents are needed helps homebuyers. It makes it easier to get a HomeReady® Mortgage that fits their financial situation.

| Income Category | Percentage of AMI |

|---|---|

| Extremely Low-Income | 30% of AMI |

| Very Low-Income | 50% of AMI |

| Low-Income | 80% of AMI |

| Moderate-Income | 120% of AMI |

“The HomeReady® program’s income limits are designed to ensure the program reaches those who truly need assistance in achieving homeownership.”

The HomeReady mortgage program is flexible when it comes to property types. You can buy a single-family home, a condominium, or even a manufactured home. It also supports multi-family properties with up to 4 units, as long as you live in one of them.

HomeReady offers fixed-rate mortgages with terms of 10, 15, 20, and 30 years. You can also choose an adjustable-rate mortgage (ARM) like 5/1, 7/1, or 10/1 ARMs. However, not all lenders offer ARMs for HomeReady loans.

| Property Type | Loan Options |

|---|---|

| Single-Family Homes | Fixed-rate mortgages (10, 15, 20, 30 years) Adjustable-rate mortgages (5/1, 7/1, 10/1) |

| Condominiums | Fixed-rate mortgages (10, 15, 20, 30 years) Adjustable-rate mortgages (5/1, 7/1, 10/1) |

| Manufactured Homes | Fixed-rate mortgages (10, 15, 20, 30 years) Adjustable-rate mortgages (5/1, 7/1, 10/1) |

| Multi-Family Homes (2-4 units) | Fixed-rate mortgages (10, 15, 20, 30 years) Adjustable-rate mortgages (5/1, 7/1, 10/1) |

Remember, the loan options available can differ by lender. So, talk to a mortgage professional to find the right loan for your needs.

The HomeReady mortgage program makes it easier to buy a home. It allows for flexible down payments, helping low-to-moderate income buyers. You can use gift funds, grants, or down payment assistance to cover the costs.

Fannie Mae’s Community Seconds program helps with down payments. It offers a second loan for the down payment and closing costs. This is great for those who can’t save the full 3%.

Lenders like Bank of America, Chase, and Wells Fargo also help. They have their own down payment assistance programs for eligible buyers.

There are thousands of down payment assistance programs across the country. They are mainly offered by state, county, and city governments. These programs help first-time homebuyers or those with lower incomes.

The help can be in the form of grants, forgivable loans, or low-interest loans. Some programs even match your contributions with Individual Development Accounts (IDAs).

HomeReady loans have interest rates similar to traditional loans. Sometimes, they can even be lower. You can choose from fixed-rate mortgage terms, with shorter terms often having lower rates but higher monthly payments.

Some lenders also offer adjustable-rate mortgages. However, these might be less common.

The HomeReady mortgage program was launched by Fannie Mae in December 2015. It helps people with lower incomes buy homes with a 3% down payment. It also considers income from different sources for loan applications.

To get a HomeReady mortgage, you must meet certain income limits. These limits are based on your area’s median income. Your income should not be more than 80% of the area’s median income.

You also need a minimum FICO score of 620. Your debt-to-income ratio should not exceed 50%. The property must be your primary residence.

The Area Median Income (AMI) Lookup Tool helps you check if you qualify for HomeReady. You can search by address, FIPS code, state, county, or city. For best results, use a full property address.

The tool shows the AMI, HomeReady Income Limit, and Special Focus Area info. This helps you see if you meet the income requirements.

HomeReady loans accept various income types. This includes wages, salaries, and self-employment income. Bonuses, commissions, pensions, and Social Security benefits are also okay.

Child support, alimony, rental income, and boarder income are accepted too. Income from non-borrowers can also be considered as a compensating factor.

HomeReady loans are for different property types. This includes single-family homes, condominium units, and homes in planned unit developments (PUDs). Co-ops, manufactured homes, and multi-family homes with 2-4 units are also eligible.

For multi-unit properties, you must live in one unit as your primary residence.

Meeting the 3% down payment for a HomeReady loan is flexible. You can use gift funds from family, home buyer grants, or down payment assistance programs. Fannie Mae’s Community Seconds program also helps with down payments and closing costs.